natwest intermediary ratesSource factory,NatWest fixed rate mortgage rates,natwest intermediary rates,Please note, we no longer display our existing customer product range on this page. You can still access existing customer rates via our broker portal. $595.00

Are you in the market for a new mortgage or looking to refinance your existing one? NatWest offers a range of mortgage products through intermediaries that cater to different needs and financial situations. By leveraging NatWest's intermediary rates, you can access competitive mortgage deals that suit your requirements. In this article, we will delve into the various aspects of NatWest intermediary rates, including fixed-rate mortgage rates, affordability criteria, contact information, and more.

Please note, we no longer display our existing customer product range on this page. You can still access existing customer rates via our broker portal.

NatWest Consent to Let Fee

If you are an existing NatWest customer considering letting out your property, you may need to obtain consent to let from NatWest. This process involves paying a consent to let fee, which allows you to rent out your property while still maintaining your mortgage with NatWest. The consent to let fee varies depending on your specific circumstances and the type of mortgage you have with NatWest. It is essential to understand the terms and conditions associated with obtaining consent to let to ensure compliance with NatWest's policies.

NatWest Existing Mortgage Customers

As an existing NatWest mortgage customer, you may be eligible for exclusive rates and deals when you choose to remortgage or switch your current mortgage product. NatWest values customer loyalty and offers incentives to existing mortgage customers to help them save on their mortgage repayments. By exploring the options available to existing NatWest mortgage customers, you can potentially secure a better mortgage deal that aligns with your financial goals.

NatWest Fixed Rate Mortgage Rates

Fixed-rate mortgages provide borrowers with the certainty of knowing their monthly repayments will remain the same for a set period, typically between two to five years. NatWest offers competitive fixed-rate mortgage rates through intermediaries, allowing borrowers to lock in a favourable interest rate and budget effectively for their mortgage payments. By comparing NatWest's fixed-rate mortgage rates using their mortgage rates tool, you can determine the most suitable mortgage deal for your circumstances.

NatWest for Intermediaries Affordability

NatWest for intermediaries assesses the affordability of mortgage applicants based on various factors, including income, expenses, credit history, and loan-to-value ratio. By demonstrating your affordability to NatWest, you can increase your chances of approval for a mortgage and secure a competitive interest rate. Understanding NatWest's affordability criteria is crucial when applying for a mortgage through intermediaries to ensure a smooth and successful application process.

NatWest for Intermediaries Contact Number

If you have queries regarding NatWest's intermediary rates, mortgage products, or application process, you can contact NatWest for intermediaries using their dedicated contact number. By speaking to a NatWest representative, you can receive personalized assistance and guidance on choosing the right mortgage product for your needs. The contact number for NatWest for intermediaries is readily available on their website and communication channels.

NatWest for Intermediaries Criteria

NatWest for intermediaries has specific criteria that applicants must meet to qualify for a mortgage. These criteria may include minimum income requirements, credit score thresholds, and property valuation standards. By familiarizing yourself with NatWest's intermediary criteria, you can prepare a strong mortgage application that meets the lender's requirements. Meeting NatWest's criteria increases your chances of approval and secures a competitive mortgage deal.

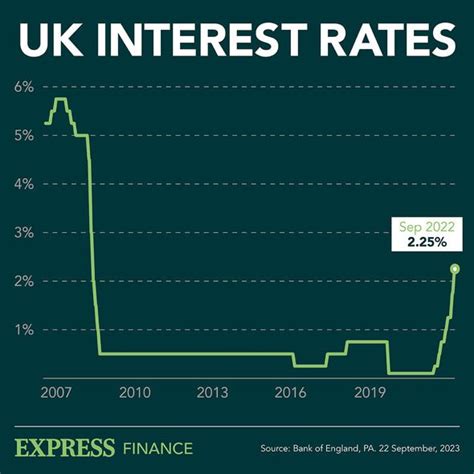

NatWest Interest Rate Scenario

The interest rate scenario plays a significant role in determining the cost of your mortgage over its term. NatWest offers competitive interest rates on their mortgage products, with the potential for fixed-rate deals to protect borrowers from fluctuations in the broader interest rate market. By staying informed about the interest rate scenario and monitoring changes in interest rates, you can make informed decisions about your mortgage, such as whether to opt for a fixed or variable rate product.

Latest NatWest Mortgage Rates

You can secure a new rate for your customer four months before their current deal ends. Quick, straight forward processing. There is no additional underwriting for standalone product transfers.

natwest intermediary ratesSource factory Find an official store near you with the Gucci store locator. Discover the latest .

natwest intermediary rates - NatWest fixed rate mortgage rates